Recommended Tips For Choosing Forex Trading Bots

Wiki Article

What Are The Most Important Factors That Influence Rsi Divergence

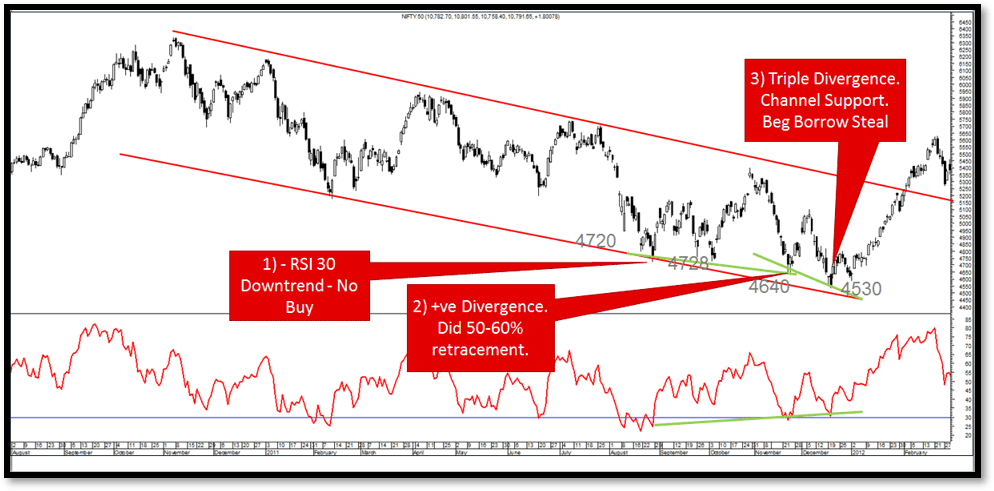

Definition: RSI diversence is a technical analysis tool that compares the direction the prices of an asset change in relation to the relative strength index (RSI).

Signal Positive RSI divergence is considered to be a bullish signal, while a negative RSI divergence is seen as bearish.

Trend Reversal: RSI Divergence can signal a trend reversal.

Confirmation: RSI divergence should be used as a confirmation tool in conjunction with other analysis methods.

Timeframe: RSI divergence can be viewed on different timeframes to gain different insight.

Overbought/Oversold RSI: RSI values higher than 70 mean overbought conditions and values less than 30 indicate oversold.

Interpretation: Understanding RSI divergence in a precise manner requires the taking into account other fundamental or technical factors. Read the best cryptocurrency trading bot for website advice including RSI divergence, backtesting strategies, automated forex trading, automated crypto trading, forex backtesting software free, automated trading platform, RSI divergence, backtesting tool, forex backtesting, backtesting and more.

What Is The Difference Between Hidden And Regular Divergence?

Regular Divergence - This is when the price of an asset is a higher level or lower than the RSI. It could indicate a trend reversal. However, it is crucial to consider other fundamental and technical factors. It is considered a less reliable signal than regular divergence, however, it could still signal a potential trend reverse.

Consider these technical factors:

Trend lines and support/resistance levels

Volume levels

Moving averages

Other indicators of technical quality or oscillators

It is important to consider these essential points:

Economic data

Specific news for companies

Market sentiment and mood indicators

Global events and their impact on the market

Before you make investments based solely on RSI divergence signals , it is important be aware of both fundamental and technical aspects. Have a look at the best forex backtesting for website info including best trading platform, forex trading, best forex trading platform, position sizing calculator, best crypto trading platform, crypto trading, software for automated trading, automated trading, best trading platform, automated trading platform and more.

What Are Backtesting Strategies For Trading Crypto?

Backtesting cryptocurrency trading strategies involves simulating trading strategies based on previous data to evaluate their likelihood of success. The following are some steps in backtesting crypto trading strategies:Historical Data: Obtain a historical data set for the crypto asset being traded, including prices, volume, and other relevant market data.

Trading Strategy: Develop the trading strategy to be test.

Simulator: Software can be used to create a simulation of the trading strategy that is based on historical data. This lets you observe how your strategy will perform in the future.

Metrics: Use metrics to assess the performance of the strategy like profitability Sharpe, drawdown or other relevant measures.

Optimization Modify the strategy's parameters and run the simulation once more to improve your strategy's performance.

Validation: Examine the effectiveness of the strategy using out-of-sample information to verify its robustness.

Remember that past performance is not an indication of future results and backtesting results shouldn't be taken as a guarantee of future results. Also, you should take into account the volatility of markets and the costs associated with transactions when using the strategy to conduct live trading. Have a look at the recommended divergence trading for website info including trading platform, software for automated trading, automated forex trading, forex backtest software, backtesting tool, automated trading software, software for automated trading, cryptocurrency trading, bot for crypto trading, forex trading and more.

How Can You Assess The Backtest Software Of Forex For Trading With Divergence?

These are the most important aspects to consider when looking at the software for backtesting forex that supports trading using RSI Divergence.

Flexibility: The software should allow customization and testing of different RSI trading strategies for divergence.

Metrics : The software must contain a variety of indicators to assess the performance RSI Divergence Strategies for trading, like profit, risk/reward, and drawdown.

Speed: This program must be efficient and fast. It should permit quick backtesting for multiple strategies.

User-Friendliness. The software must be easy to understand even for people not having a technical background.

Cost: Take a look at the cost of the software. Also, consider whether the software falls within your financial allowance.

Support: Excellent customer support should be provided, including tutorials and technical assistance.

Integration: Software must be compatible with different trading tools such as charts software, trading platforms, and trading platforms.

It is important to test the software with the demo account prior to purchasing an annual subscription. This allows you to verify that the software meets your needs and are comfortable using it. Take a look at recommended automated crypto trading for more tips including crypto backtesting, crypto trading bot, crypto trading, forex backtesting software, forex trading, forex trading, crypto trading backtester, best crypto trading platform, trading divergences, automated trading software and more.

How Do The Automated Trading Software's Cryptocurrency Trading Bots Function?

The bots for trading cryptocurrency work within automated trading software, following an established set of guidelines and making trades for the user's behalf. Here's how it works. Trading Strategy: The client designs the trading strategy, which includes the rules for entry and exit, size of the position and risk management rules and risk management.

Integration: Through APIs the trading bot is able to be integrated with cryptocurrency exchanges. This allows it to access real time market data and execute trades.

Algorithms are algorithms that analyze market data to make trading decisions based in part on a specific strategy.

Execution. The bot makes trades based upon the strategy of trading. It does not need manual intervention.

Monitoring: The robot continually examines the market and makes adjustments to the strategy of trading if necessary.

The use of trading robots for cryptocurrency is useful in executing complex or routine trading strategies. This reduces the need to manually intervene and allows traders to benefit from market opportunities throughout the day. Automated trading comes with risks. There are security risks as well as software mistakes. You also have the chance of losing control of the trading decisions you make. Before using any platform to trade live, it is vital to thoroughly test it.