New Reasons For Picking RSI Divergence Trading

Wiki Article

Good Facts For Picking An RSI Divergence Strategy

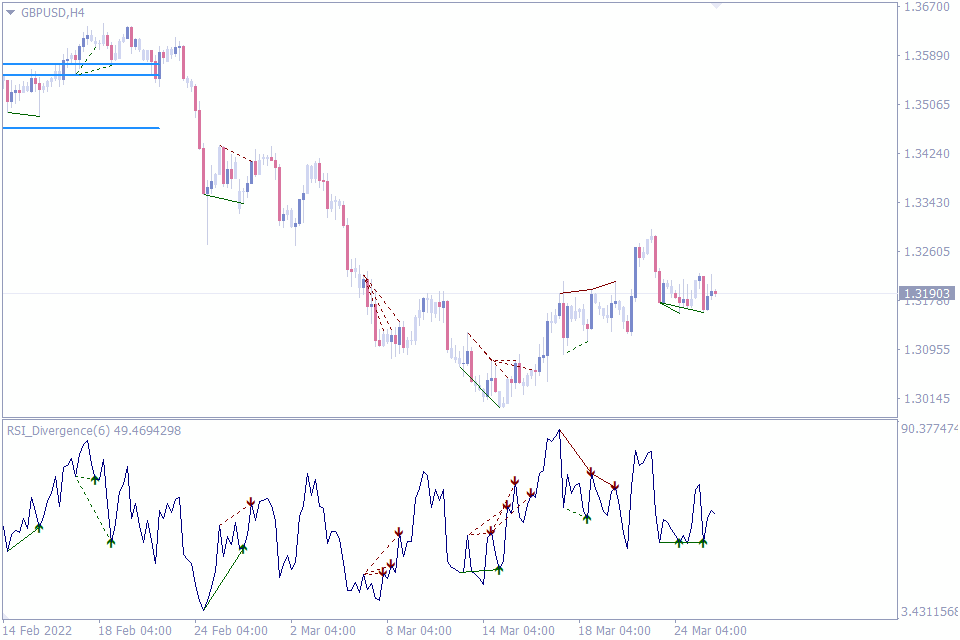

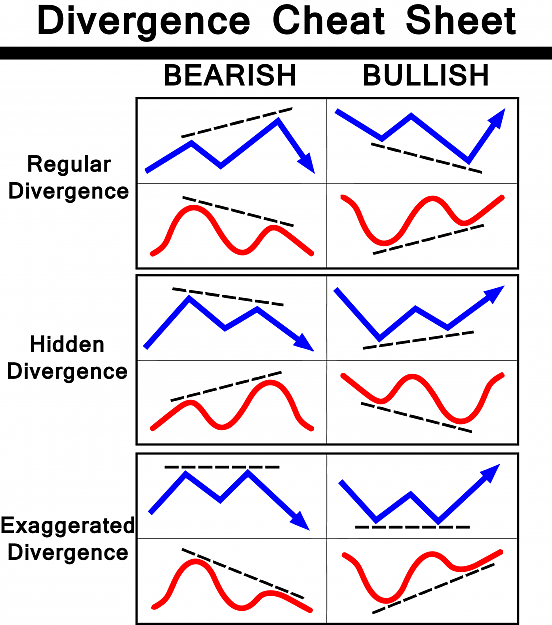

Okay, let's get started with the most obvious question. Now, let us examine what RSI Divergence looks like and what information about trading can be learned from it. If the price action on your chart and the RSI signal are not in the same synchronization, a divergence is likely to occur. In a downtrend market where the price action creates lower lows while the RSI indicator is able to make lower lows. A divergence is when an indicator doesn't agree with the price action. This should be an indicator that you should be attentive to the market. Both the bullish RSI and the bearish RSI divergence are clearly evident in the chart. The price move was reversed by both RSI Divergence signals. Let's talk about one last topic before proceeding to the topic that is exciting. Follow the recommended automated trading for more advice including automated trading software, automated cryptocurrency trading, crypto trading bot, software for automated trading, cryptocurrency trading bot, position sizing calculator, trading divergences, trading with divergence, bot for crypto trading, trading platforms and more.

What Can You Do To Analyze The Rsi Divergence?

We use the RSI indicator to identify trends that have reversals. To do this, it's essential first to be in a market that is trending. Next, we use RSI diversgence to identify weak points within the current market trend. In the end, we are able to utilize that information to find the appropriate time to record the trend reverse.

How To Recognize Rsi Divergence In Forex Trading

Both Price Action and RSI indicators have both reached higher highs towards the beginning of the uptrend. This usually indicates that the trend seems solid. In the final phase of the trend, price forms higher highs and the RSI indicator forms lower highs. This indicates that there is something to be watching within this chart. In this case, we must pay attention to markets, as both the indicator's and price action are not in sync. This means there is an RSI divigence. In this case it is the RSI Divergence indicates a trend that is a bearish. Check out this chart to see what happened following the RSI divergence. The RSI divergence is extremely precise in identifying trends reversals. How do you recognize the trend's reverse? Let's discuss four practical trade entry techniques that provide better entry signals when combined with RSI divergence. View the best forex tester for website examples including trading platform cryptocurrency, trading platform, divergence trading forex, trading divergences, automated forex trading, crypto trading, cryptocurrency trading bot, backtesting trading strategies, cryptocurrency trading, crypto trading and more.

Tip #1 – Combining RSI Divergence & Triangle Pattern

There are two kinds of triangle chart patterns. One is the Ascending Triangle pattern, which works in an uptrend as a reverse pattern. Another variation is the descending circle pattern that can be used as a reverse pattern when the market is in an upward direction. The forex chart below displays the descending Triangle pattern. The market was experiencing an uptrend, and the price began to fall. At the same time, RSI also signals the divergence. These indicators reveal the weak points in this trend. We can see that the momentum of the current upward trend has diminished and the price has ended in a triangular pattern that descending. This confirms the reverse. Now is the time to complete the trade. Like in the previous instance we utilized the same techniques to break out for this trade as well. Let's now move on to the third method of trading entry. This time, we will blend trend structure with RSI diversgence. Learn to trade RSI Divergence whenever trend structure alters. Follow the recommended forex backtesting for site tips including forex trading, automated cryptocurrency trading, backtesting trading strategies, bot for crypto trading, crypto trading, forex backtesting, backtesting tool, position sizing calculator, stop loss, bot for crypto trading and more.

Tip #2 – Combining RSI Divergence with the Head and Shoulders Pattern

RSI divergence helps forex traders identify market reversals, isn't it? Combining RSI diversence along with other indicators of reversal like the Head and Shoulders patterns can increase our trade probability. That's fantastic! Let's see how we can time our trades using RSI divergence and the pattern of the Head and Shoulders. Related: How to Trade the Head and Shoulders Patterns in Forex - A Reversal Trading strategy. A stable market is required before we consider the entry of trades. The markets that are trending are the best as we are seeking an inverse trend. Look at this chart. View the most popular trading with divergence for blog tips including divergence trading forex, trading platform crypto, forex tester, trading platform crypto, trading with divergence, best crypto trading platform, software for automated trading, position sizing calculator, forex backtest software, automated cryptocurrency trading and more.

Tip #3 – Combining RSI Divergence and the Trend Structure

Trends are our friend. Trading should be done in line with the trend so long as the market is trending. This is how professionals teach us. However, the trend will not continue forever. At some point, it will reverse. Let's look at how we can detect reversals early time by looking at the structure of the trend and the RSI divergence. We all know that the uptrend makes higher highs, while the downtrend is making lower lows. This chart illustrates this point. If you examine the chart to the left, you'll see that it is a downtrend. It has a series lows and higher highs. Next, take a look at "Red Line" which shows the RSI divergence. Price action creates Lows however, the RSI makes higher lows do you think? What's the meaning of all this? Despite the market creating low RSI This means that the ongoing downtrend in momentum is losing its momentum. View the top trading divergences for more info including RSI divergence cheat sheet, divergence trading, divergence trading, bot for crypto trading, RSI divergence, RSI divergence, trading platform crypto, best crypto trading platform, forex backtest software, backtester and more.

Tip #4 – Combining Rsi Divergence And The Double Top/Double Bottom

Double-bottom or double-top is a reversal chart that develops after a lengthy move or the emergence of a trend. In the double top, the first top is formed when the price hits an unattainable level that cannot be broken. Once that level has been reached, the price will dip a little, and then bounce back to the previous level. If it bounces once more from the point, you've got a DOUBLE OPTION. Check out this double top. The double top you see above is a picture of two tops that were created by a powerful move. The second highest top was unable to break the level of the first. This is a strong indication that the buyers are struggling to go higher. The same principle applies to the double bottom, but it is done in reverse. We use breakout entry. This means that we sell the trade when the trigger line is beneath the price. We recouped our profits after the price fell to below the trigger line. QUICK EARNINGS. The same techniques for trading can be employed for double bottom too. Look at this chart to understand how to trade RSI divergence and double bottom.

Be aware that this is not the only strategy that works for all traders. There isn't any one trading method that is perfect. Every strategy for trading has losses. We make consistent profits through this trading strategy however we have a strict risk management and a technique to reduce our losses rapidly. That way we can minimize our drawdown and also open the doors for big potential for upside.